Quick Overview

Raga Finance is a vault-based DeFi protocol that simplifies cross-chain yield farming by offering ERC-4626 vaults tailored to different risk profiles. Users deposit assets like ETH, BTC, or USDC into Raga's smart vaults across various Layer-1 or Layer-2 networks and receive vault tokens representing their strategy share. Each vault automatically deploys assets into curated on-chain strategies with auto-compounding and looping, categorized by risk level to match investor appetite.

Key Features

- ERC-4626 Smart Vaults: Standardized vault infrastructure with automated strategy execution and yield optimization

- Risk-Categorized Strategies: Low, medium, high risk vaults with transparent APY targets and risk metrics

- Cross-Chain Harmonization: Unified yield access across multiple chains with instant liquidity bridging

- Auto-Compounding: Automated harvesting and reinvestment of rewards to maximize compound returns

- Vault Token Liquidity: Tokenized staked funds enabling withdrawals via tradeable vault shares

How to use

Raga Finance

Prerequisites

- Compatible wallet (MetaMask, WalletConnect supported wallets)

- Supported assets for deposits (ETH, BTC, USDC, USDT on various chains)

- Gas tokens for respective networks

- Understanding of DeFi risks and vault strategies

Getting started

Connect Wallet

Visit app.raga.finance, connect compatible wallet, ensure network compatibility with desired vault

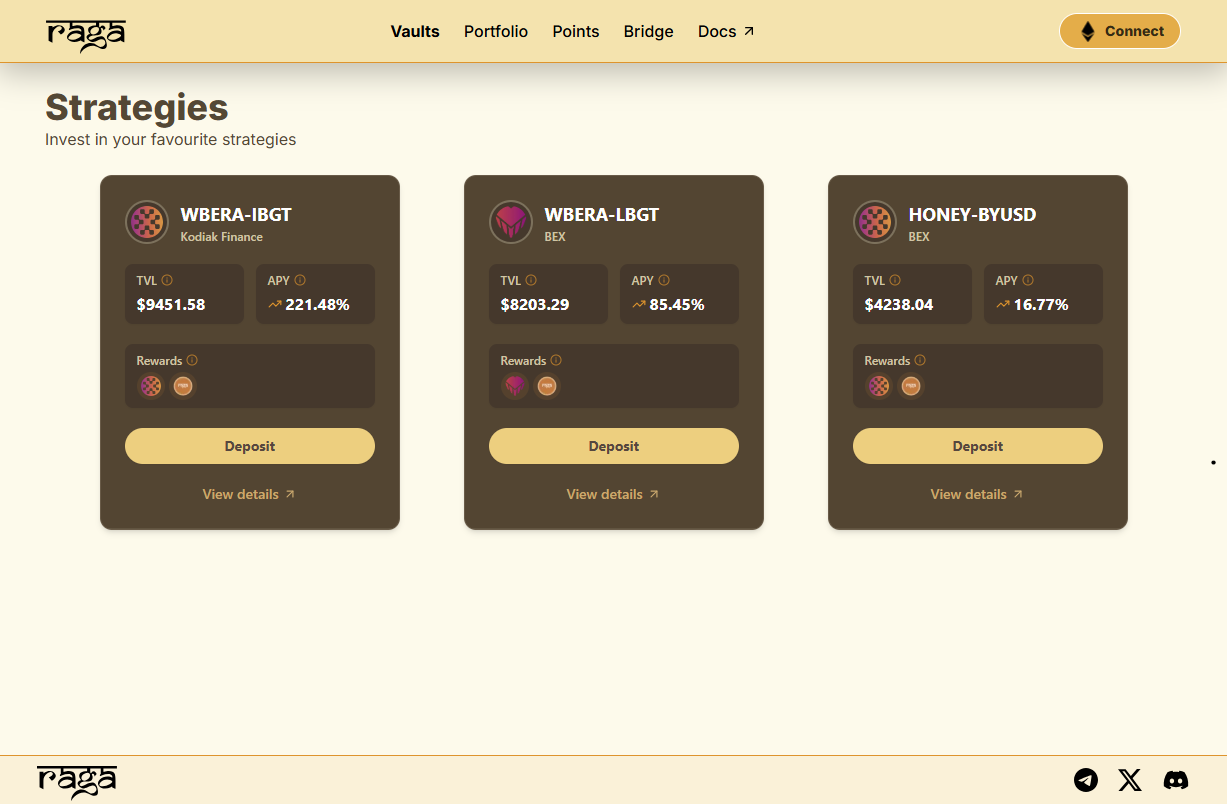

Choose Vault Strategy

Browse available vaults by risk level and APY, review strategy details, historical performance, and underlying protocols

Deposit Assets

Select deposit amount, approve token spending, confirm vault deposit transaction to receive vault tokens

Monitor Performance

Track vault performance via dashboard, view yield accumulation, compounding frequency, and strategy updates

Withdraw or Reinvest

Redeem vault tokens for underlying assets plus yields, or compound into higher-yield strategies

Tips & Best Practices

- Risk Assessment: Start with low-risk vaults to understand platform mechanics before moving to higher-yield strategies

- Diversification: Spread deposits across multiple risk categories and chains to minimize concentrated exposure

- Yield Timing: Monitor gas costs and vault rebalancing schedules for optimal entry/exit timing

- Strategy Research: Review underlying protocols and strategies before depositing - understand counterparty risks

- Regular Monitoring: Check vault performance regularly as strategies may shift based on market conditions

Technical Information

Nexio (MoveVM) & EVM (Ethereum, Arbitrum, Optimism, Polygon)

Near-instant deposits, strategy execution varies by underlying protocols

ERC-4626 vault standard + automated strategy execution engine

Multi-sig governance, audited vault contracts, risk management protocols

Frequently Asked Questions

How do Raga vaults work?

Deposit assets into ERC-4626 vaults that automatically execute yield strategies - receive vault tokens representing your share of accumulated yields

What are the risk categories?

Low (stablecoin strategies), Medium (blue-chip crypto), High (leveraged/exotic strategies) - each with clear APY targets and risk metrics

Can I withdraw anytime?

Most vaults allow flexible withdrawals, some strategies may have lock-up periods during active deployment cycles

How are yields generated?

Through curated DeFi strategies: lending, liquidity provision, yield farming, auto-compounding across integrated protocols

What chains are supported?

Multiple EVM chains with plans for Nexio integration - vault tokens work across supported networks via bridging