Quick Overview

Mizu dissolves liquidity silos across EVM, MoveVM and other chains. Users deposit assets into Gateway Contracts and receive yield‑bearing Shadow Tokens on Mizu‑MoveVM. Those tokens automatically farm in cross‑chain Auto‑Yield Vaults until LPs or protocols rent the capital through an on‑chain Liquidity Order‑book, paying extra incentives. The result: a single, border‑less liquidity layer that maximises idle capital.

Key Features

- Gateway Contracts – canonical bridges that mint Shadow Tokens 1 : 1

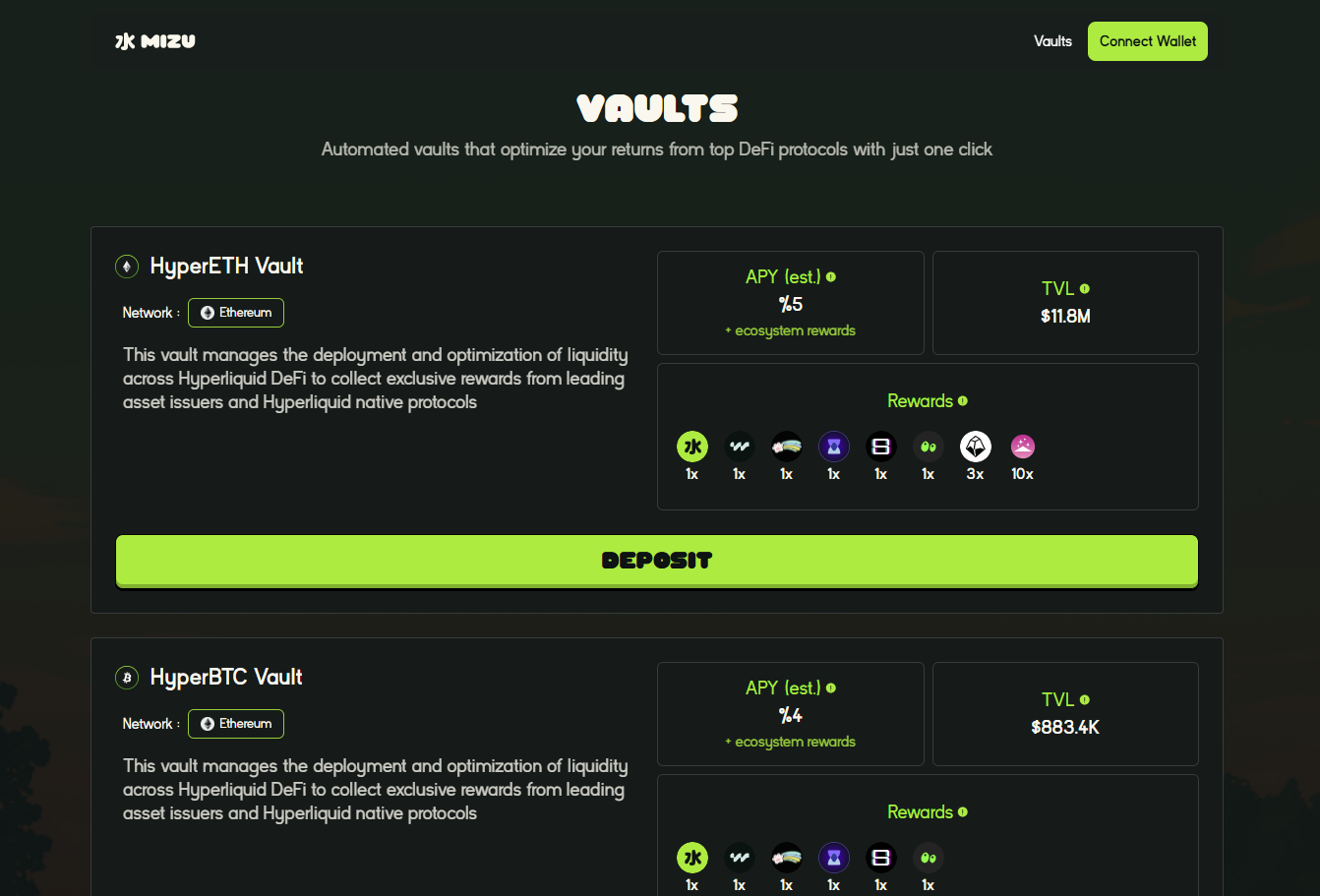

- Auto‑Yield Vaults – deploy assets to Hyperliquid, EigenLayer LSTs & more

- Liquidity Order‑book – marketplace where projects bid for pooled liquidity

- Shadow Tokens – freely composable receipts redeemable for principal + yield

- Multi‑VM Support – MoveVM core with modular adapters for EVM & alt‑VMs

How to use

Mizu

Prerequisites

- Compatible wallet (MetaMask, WalletConnect, or similar)

- Basic understanding of DeFi and yield farming concepts

- Assets on supported networks (Ethereum, Arbitrum, Optimism, etc.)

- Internet connection for cross-chain operations

- Wallets on the source chain + Mizu‑MoveVM

- Depositable assets (ETH, stETH, USDC, etc.)

- Basic understanding of bridge and vault yield mechanics

Getting started

Connect Wallets

Open the dApp and connect both your source‑chain wallet and Mizu wallet.

Deposit Assets

Send tokens to the Gateway; receive Shadow Tokens instantly on Mizu.

Earn Auto‑Yield

Shadow Tokens auto‑farm in vaults – yield accrues in real time.

Rent Liquidity (Dev)

Post bids on the Order‑book to borrow pooled liquidity for your protoc

Redeem / Withdraw

Burn Shadow Tokens at any time to reclaim the underlying + yield.

Tips & Best Practices

Technical Information

MoveVM, EVM, SolanaVM

Modular MoveVM with unified liquidity pools and atomic cross-chain execution

Trust-minimized canonical bridges + MoveVM parallel execution + Avail DA

Frequently Asked Questions

What chains are supported?

Mizu supports EVM chains (Ethereum, Arbitrum, Optimism), MoveVM networks, and SolanaVM. Router Protocol enables cross-chain interopabillity .

How does yield optimization work?

Mizu's algorithms automatically allocate your deposits to the highest-yielding DeFi venues like EtherFi's eETH and eBTC, continuously rebalancing for optimal returns.

What are mirror tokens?

Mirror tokens are 1:1 yield-bearing representations of your deposits on Mizu Chain. They earn yield while remaining fully liquid and usable in DeFi protocols.

How do I maximize yields?

Deposit into multiple vaults, utilize mirror tokens in other protocols, and take advantage of compound earnings through Mizu's automated rebalancing.

How is this different from normal bridges?

Gateway Contracts mint yield‑bearing receipts and plug into on‑chain vaults—bridging plus auto‑yield in one step.